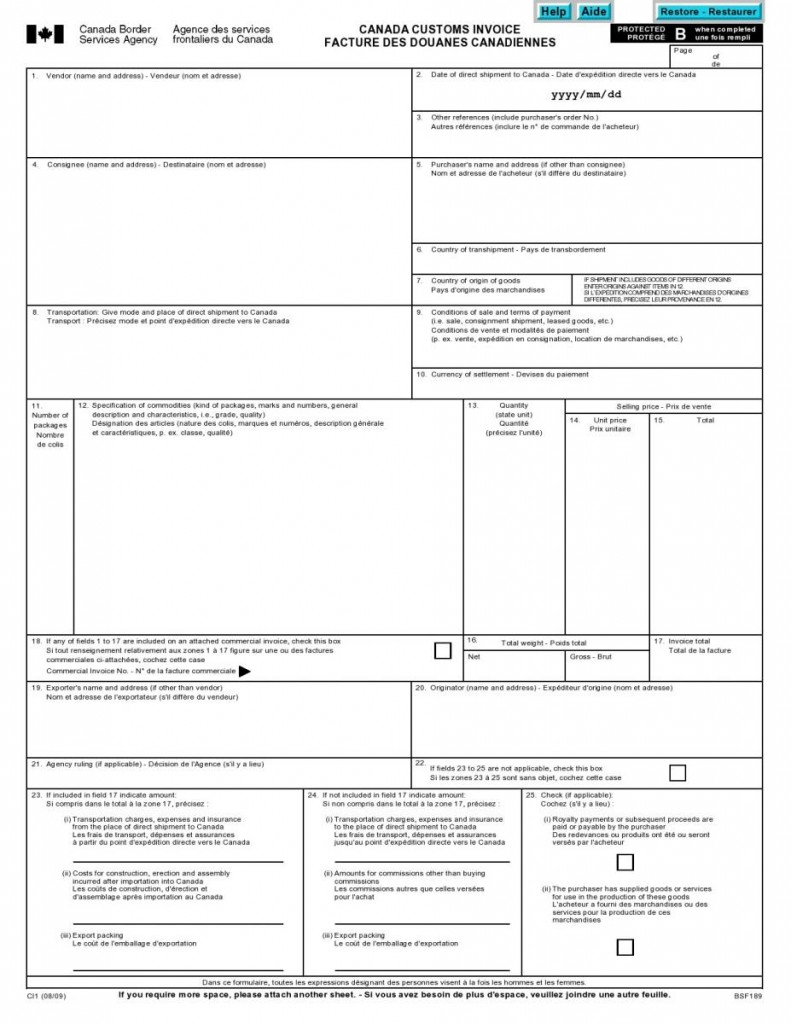

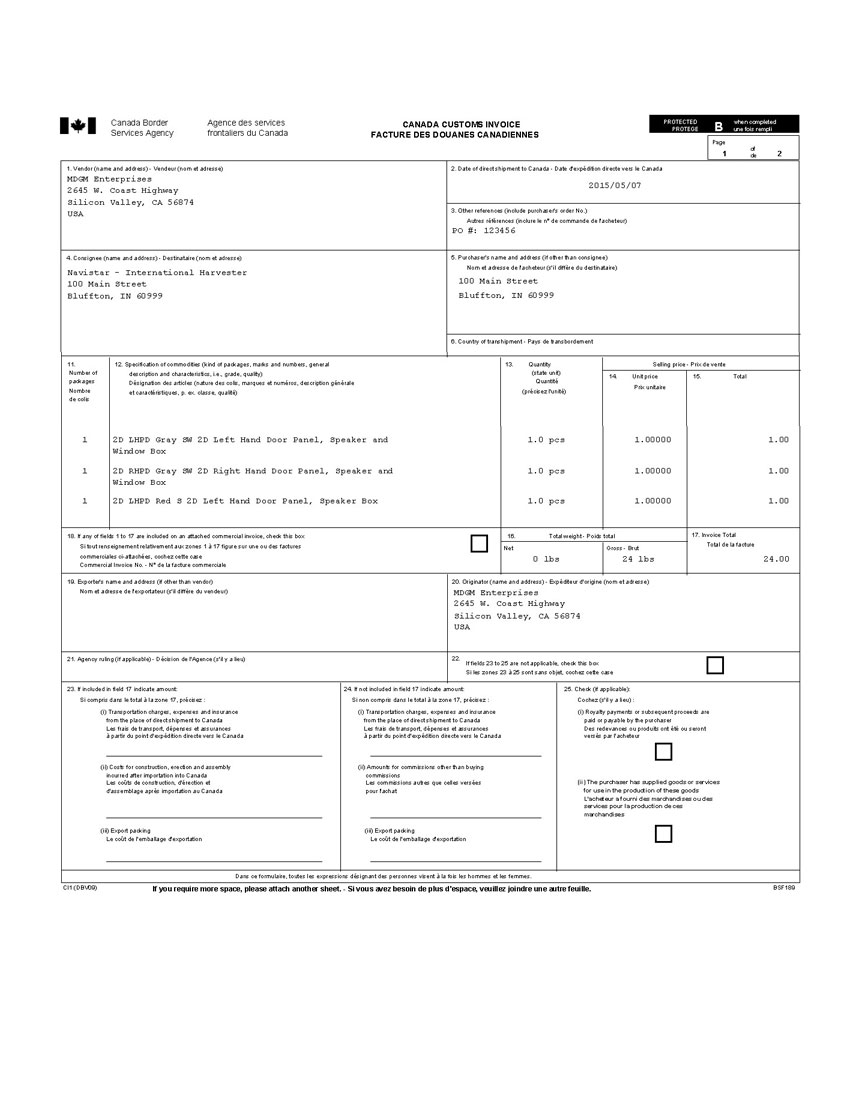

Canada Customs Invoice

Who Charges the Customs Clearance Fee. Under the doctrine of informed compliance an importer must correctly classify and value imported merchandise.

Understanding The Canada Customs Invoice

OriginDestination Customs Clearance Agents.

. Include Customs Harmonized Codes if known. A DHL commercial invoice is a document prepared by an exporter that classifies the contents or merchandise of a shipment in order that customs can properly receive and clear the shipment. Forwarder or Customs BrokerAgent Charge At.

These documents are often used by governments to determine the true value of goods when assessing customs duties. A customs clearance fee is levied by the customs clearance agent or customs broker to cover the cost of preparing and filing customs documents. Customs brokers or clearance.

Complete description of each item being shipped. The Canada Border Services Agency CBSA is responsible for providing integrated border services in Canada including customs immigration and luggage inspection services. Canadian customs broker Clearitca is the easiest way to complete your customs clearance in Canada.

If the information on the Commercial Invoice matches the customs entry form then the Customs Agent can deduce that the package is safe and secure. If the International shipment youre sending is going to a country outside of the UK and contains items of a commercial value youll need to pr. Shipments to Canada do not require an EEI except in.

This will make the decision of the cargo package to enter into the country quicker. The goods cost 28000. What is this Fee.

The importer uses the CCI to pay the seller for the goods. To find out how much youll need to pay youll need to check the commodity code for umbrellas and apply the import duty rate for that code 65. CBSA officers inspect and assess these items for applicable customs duties and taxes.

The document shows that the taxes and duties have been appropriately assessed before the continuation of the shipment. One is attached to the shipment at customs. Customs Clearance Fees Charges.

The seller uses the Canada Customs Invoice to bill for goods and the buyer uses this same invoice to pay. A commercial invoice is an invoice that you include when youre shipping goods to other countries. Customs officials assess duties and taxes based on information provided on the air waybill the Commercial Invoice and other relevant documents.

Canada Customs Invoice CCI or Commercial Invoice. Customs administrations will have new obligations to ensure fairness and integrity in customs work. Call 1-888-668-7595 to speak to an agent right now.

Diesel 4379gal Regular 3629gal Premium 4429gal. The commercial invoice is one of the main documents used by customs in determining customs duties. Note that the good still needs to qualify for USMCA tariff treatment and the invoice.

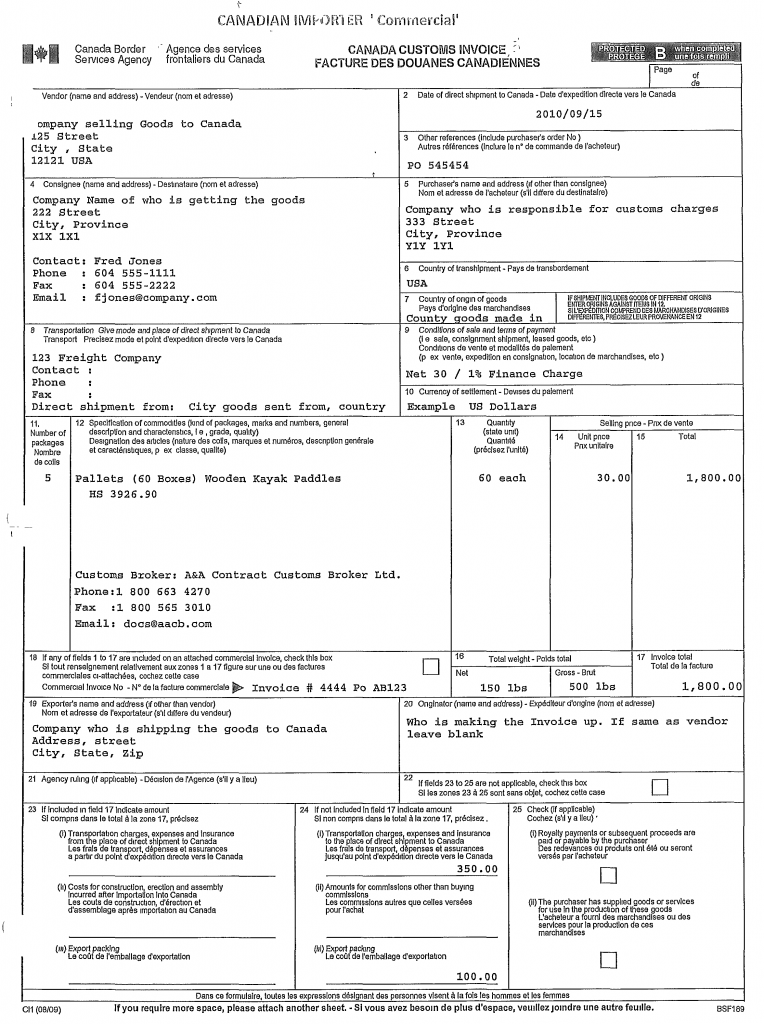

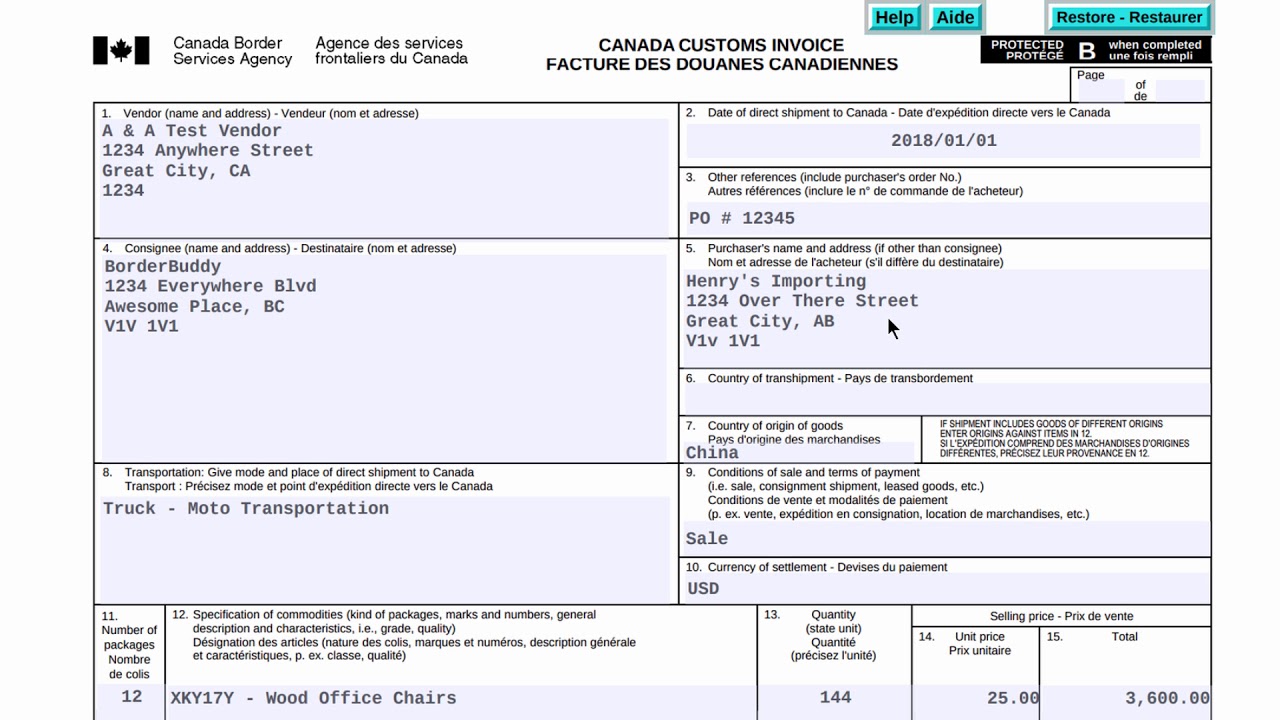

A proforma invoice is a preliminary bill of sale that is sent to the client before the work is completed. Form CI1 Canada Customs Invoice page 1 of 1 References Issuing office Assessment Unit Trade Policy Division Trade Programs Directorate Programs Branch Headquarters file 7600-6 Legislative references Customs Tariff chapter 98 Other references D11-4-2 D13-4-7 D17-1-1 D17-1-5 Superseded memorandum D. Printing your customs documents.

This form is used to provide the necessary information to customs for all Canada-bound commercial goods. A commercial invoice is a bill for the goods from the seller to the buyer. In many cases companies use the Canada Customs Invoice or CCI a special invoice designed by the government when shipping goods abroad.

Its a commitment to goods or services that have yet to be delivered. If you are using an express shipping service they will be able to help you recover any missing paperwork. In some countries duties and taxes must be paid before the goods are released from customs.

A Canada Customs Invoice CCI or Commercial Invoice is required for every commercial entry into Canada. I certify that the goods referenced in this invoicesales contract originate under the rules of origin specified for these goods in the North American Free Trade Agreement NAFTA. Customs documents are available to print off from your Parcel Monkey account plus you will be sent an email with a link to download and print them off.

Purchase order or invoice number if applicable. Australia Canada European Union France Ireland New Zealand. Canada and Mexico will be required to publish information like import export and transit requirements and fees charges and penalties on the Internet.

It is best to print off 3 copies as during transit customs officers may remove a copy before the package is sent on. D1-4-1 January 6 2012 Date modified. Imagine you need to import a shipment of garden umbrellas from Canada to the US.

The exporter uses the CCI to collect payment from the buyer. Pages 6162 n UPS TradeAbility and UPS Paperless invoice Page 63. The form may be prepared by the supplier importer or customs broker.

Name and address of purchaser importer if different from the consignee including a contact name and telephone number. The problems for importers and customs brokers begin however when the commercial invoice from the foreign supplier either is not on a FOB Port basis or does not include all dutiable costs. COMMERCIAL INVOICE EXPLAINED.

Customs Invoice - Mainly needed for the countries like USA Canada etc. Check the return to CBSA option on the E14 Invoice. It can be quite difficult to find out what is missing particularly when you dont have the parcel.

Other countries may require a separate customs invoice which essentially has the same information as a commercial invoice but in a specified format. What is the item made of. For shipments to Canada valued at less than CAD 1600 the following statement can be written on the Commercial Invoice in place of the NAFTA Certificate of Origin.

Customs authorities in some countries may allow pro forma invoices preliminary invoices to determine the import duties and taxes. As well the document. What is the item.

Diesel 154ltr Regular 128ltr Premium 156ltr. Updated May 31 2022. The Canada Border Services Agency CBSA collects provincial sales taxes PST and harmonized sales taxes HST according to the province of residence on most taxable imports valued at over CAN20.

What is it used for. It facilitates entry of goods in the importing country at preferential tariff rate. Even simple mistakes like the seller forgetting to attach an invoice or CN22 customs form can cause significant delays to your shipment.

In major airports CBSA agents are assisted by dog handlers and dogs that have been specially trained to detect restricted or prohibited items such as fruit meat and cheese. SeCTion 3 Import Rates into Canada Pages 4457 SeCTion 5 UPS Air Freight Services Pages 6466 SeCTion 6 Additional Services Pages 6775 SeCTion 4 Customs Brokerage n Customs Clearance Rates into Canada Pages 5960 n Customs Clearance Rates into the US. Canada Customs requires certain information to be provided.

It is prepared on a special form being presented by the Customs authorities of the importing country. Canadian Commercial Invoice For the sole use of sending a package from outside of Canada and into the country. You Need 2 Copies of the Canadian Customs Invoice.

A shipments duty and tax amount is based on the following. Its frequently sent to declare the value of goods for customs for a smooth delivery process.

31 Printable Canada Customs Invoice Forms And Templates Fillable Samples In Pdf Word To Download Pdffiller

Canada Customs Invoice Pdfsimpli

21 Steps To A Completed Canada Customs Invoice A A

Canada Customs Invoice Coastline Express

Free Canada Customs Commercial Invoice Template Form Ci1 Pdf Word Excel

Canada Customs Invoice Requirements Youtube

Memorandum D1 4 1 Cbsa Invoice Requirements

Posting Komentar

Posting Komentar